Las Vegas Tax Rate

Calculating Las Vegas Property Taxes.

Las vegas tax rate. The minimum combined sales tax rate for Las Vegas Nevada is 838. Las Vegas 2021 Payroll Tax - 2021 Nevada State Payroll Taxes. Answer 1 of 6.

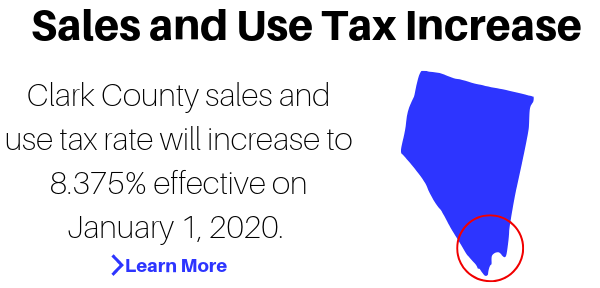

The 8375 sales tax rate in Las Vegas consists of 46 Nevada state sales tax and 3775 Clark County sales tax. So what is the Las Vegas sales tax rate. Any idea of the taxes and fees and.

The Nevada income tax has one tax bracket with a maximum marginal income tax of 000 as of 2021. Depending on the zipcode the sales tax rate of Las Vegas may vary from 825 to 8375 Every 2021 combined rates mentioned above are the results of Nevada state rate 46 the county rate 365 to 3775. The County sales tax rate is 378.

From 141 to 22 ABV the rate is 130 per gallon and from 221 to 80 ABV which includes most liquors the rate is 360 per gallon. The 89103 Las Vegas Nevada general sales tax rate is 8375. There is no applicable city tax or special tax.

We can also see the flat nature of Nevada state income tax rates at 0 regardless of income and status. The current total local sales tax rate in Las Vegas NV is 8375. Tax Bracket gross taxable income Tax Rate 0.

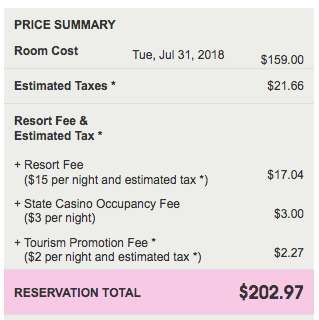

Below is a list of hotel resort fees and what it includes. There is no city sale tax for Las Vegas. Combined Sales Tax Rate for Purchases in Las Vegas.

:max_bytes(150000):strip_icc()/las_vegas-5bfc325046e0fb00260c61b6.jpg)